Watch out!There is More Market Turmoil ahead.

Ouch! Maybe It's time to change your trading strategy

You should be careful. After the CPI, the US stocks went out of a rare pulse rise under the expectation of slowing interest rate hikes. The S&P level was close to 4100 points. We shared the overall trend rhythm of US stocks very early before, and it is very likely that after bottoming out, there will be a double dip around 4100 points, and the current change is likely to be after Poland was attacked.

To our surprise, S&P futures did not turn down after the attack on Poland, but actually rose slightly to test the high of 4050 points, completing the touch of the "wall of worry" we mentioned repeatedly before.

Why? Quite simply, the market is not so gullible!

Just like the story of the Cuban missile crisis , if the rumors of Soviet missile strike are false, it is definitely the right choice to buy the stock index futures when the rumors appear, because there will be short covering after rumors dispeling in the market. What's more, the attack on Poland actually indicates the marginal easing of the Ukrainian-Russian war.

And if the rumors are true and the consequences of an escalation of war are horrific, the right or wrong of the deal will be meaningless.

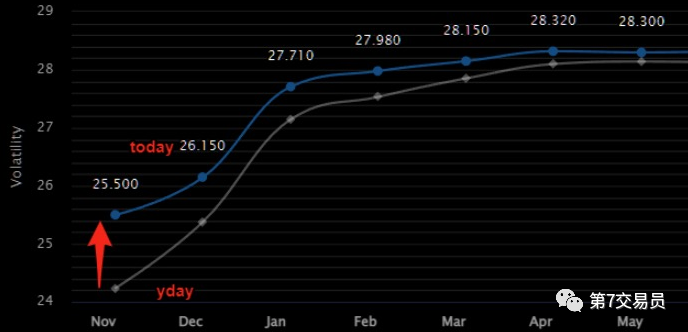

Therefore, after the first important resistance level of Big bounce is touched, the volatility of US stocks will begin, and the volatility has obviously increased.

Moreover, from the comparison of the trend of HYG and S&P, the stagnation of bond rebound has given US stocks more signals to open a double dip

We should understand that the previous sharp rebound in the global market was triggered by four favorable resonances: one is the expected slowdown in interest rate hikes, the other is the beginning of breaking the ice between China and America; the expected chinese reopen, and the other is the marginal easing of the Ukrainian-Russian war.

It can be said that these benefits have been priced in different ranges into the market trend. Of course, the possibility of these benefits is high or low. If any benefits are falsified, the market may turn around at any time.

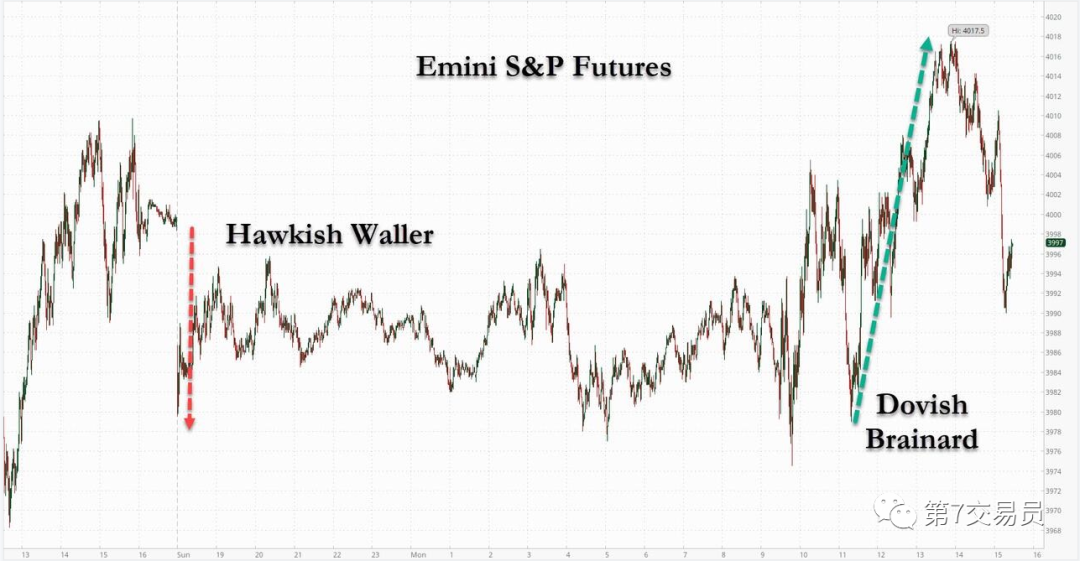

Therefore, U.S. stocks have come to a tight balance stage . You can look back at yesterday's trend of S&P futures. Two different Fed officials delivered completely different speeches of one hawk and one dove, and the result was as below:

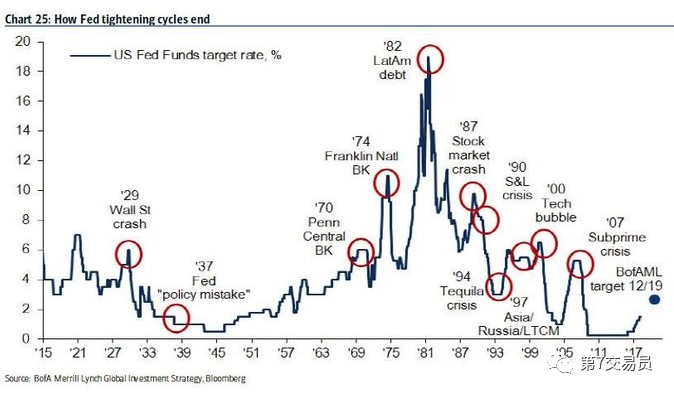

This shows that the current market sentiment is very fragile, and any hawkish negative will cause great shocks. From the Fed's previous interest rate hikes, there is no time that ended without triggering a huge recession or economic crisis

Then there is still a large expectation in the market that the Fed will not withdraw from tightening before it triggers another major recession.

What's more, the liquidity crisis in the US stock market has become more and more obvious. The collapse of digital currency and the bankruptcy of FTX both show that the most sensitive assets have started to collapse before the Federal Reserve took the scale reduction seriously.

Although the Federal Reserve mentioned the balance sheet reduction many times, but it still holds 30 trillion liabilities in its hand. Therefore, the future fate of US stocks is only in the hands of inflation.

We have already shared that the last CPI data can't explain anything. The last straw that crushes the camel will only be the second CPI. If the signs given twice are that inflation has peaked, then the Fed may really have no reason to continue to tighten sharply.

Another thing to be careful about is that: the market has never started to price in the impact of recession. At present, a large number of technology companies have laid off employees, with meta laying off 13% of employees, Twitter laying off 50%, Microsoft laying off 1,000 employees and snap laying off 20%. . . .

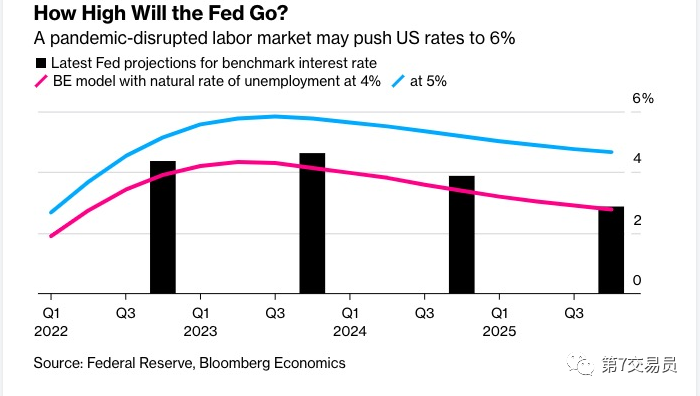

These signs of unemployment have not yet triggered expectations of a widespread recession, According to Bloomberg's forecast, if the Federal Reserve does not withdraw from raising interest rates in time due to the peak of inflation, the interest rate end of 5% will trigger the unemployment rate to 4%, and the interest rate end of 6% will trigger the unemployment rate to 5%. From the historical recession indicators, the unemployment rate above 4% will trigger a long-term recession.

Once the recession begins to be priced in, the double dip trend of US stocks will be very exciting.

Finally, let's talk about the latest news.American officials have revealed that the missile attacked in Poland was sent by Ukraine to frame Russia, so the good show began. The behavior in Europe and the United States has obviously intended to abandon Ukraine, and the war will almost certainly not continue to escalate, but it has taken a big step towards the end.

However, from the trend of the United States, Hong Kong and chinese stocks, this expectation seems to have been fully priced in.

$E-mini Nasdaq 100 - main 2212(NQmain)$ $E-mini Dow Jones - main 2212(YMmain)$ $E-mini S&P 500 - main 2212(ESmain)$ $Gold - main 2212(GCmain)$ $Light Crude Oil - main 2212(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

good