Market Trend Rebound or Stay In a Correction? Did You Buy the Dip?

Major Indexes Rebounded Powerfully From Fresh Lows

The stock market plunged to fresh lows last week but then rebounded powerfully. Risk markets remain on edge as the Ukrainian war rolls on and the impact on global finance to the locking out of Russia continues to unfold.

- Currency markets are seeing an inversion in USD strength as safe-haven buying in Yen picks up;

- Commodity currencies including the Aussie and Loonie are soaring higher as oil again pushes more than 3% higher;

- Gold remains tentatively above the $1900 per ounce level;

- Bitcoin has shot out of the gates to launch itself past the $41,000 level, taking out the previous weekly high.

Technical Analysis Shows the Upward Trend

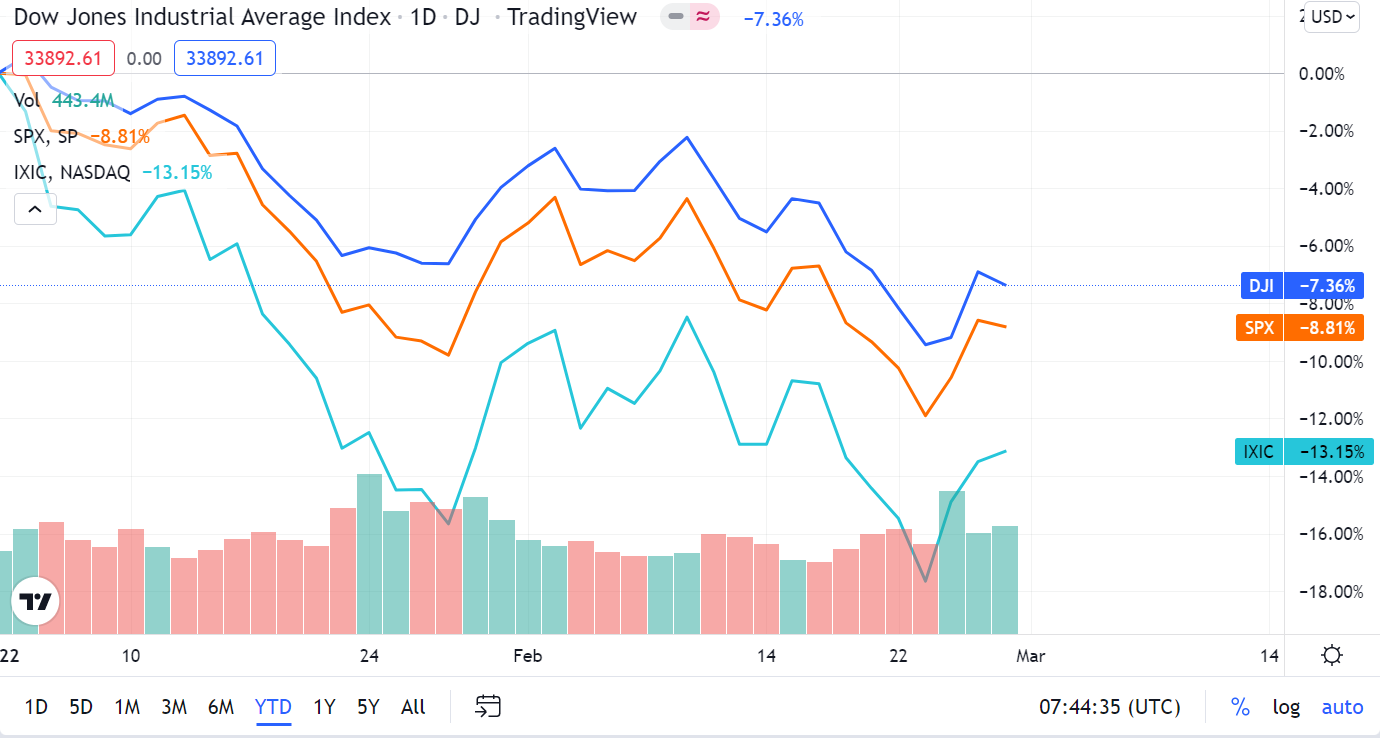

From a technical point of view, since last Thursday, the three major U.S. stock indexes have rebounded, and the monthly-level moving average shows that the three major indexes are above the monthly supportive level, the upward trend pattern has not changed.

So far this year, $DJIA(.DJI)$ fell 7.36%, $S&P 500(.SPX)$ fell 8.81%, and $NASDAQ(.IXIC)$ fell 13.15%.

Tuesday will be Day 4 of the new rally attempt, which means a follow-through day — which signals the start of a new uptrend — is possible anytime now.

Market Tend Rebound vs. Keep Volatile

Regarding the short-term trend of U.S. tend to rebound or volatility, the relevant points are as follow:

Rally: "After Last Thursday's positive reversals and Friday's gains, the stock market rallied in the final 90 minutes Monday, keeping alive the hopes for a bottom. The market is on track for a possible rally confirmation as early as this week. Market bottoms often happen when investors least expect it, so be ready with a well-researched watchlist."According to IBD's The Big Picture column.

Correction: The market is in a correction, with the Nasdaq briefly reaching the 20% down bear threshold. But a new market rally attempt is underway. Investors should still be cautious until there's a confirmed uptrend, but they should be building up their watchlist. In addition, while getting back into the market may pay off long-term, experts say panic sellers often feel anxious about when to reinvest, according to research from the Massachusetts Institute of Technology.

Question For You:

- Will Market Trend Rebound or Stay In a Correction?

- Did You Buy the Dip?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

It would seem that the market has rebounded basing on the charts but the war in Ukraine has escalated. The Russian troops have been put on Nuclear Deterrance Alert. What is means is the Nuclear Weapons are ready to be fired whenever the order is given.

In view of this, it is best to slowly dollar cost average into quality stocks like Apple and Microsoft. Also to diversify into safe haven assets like Gold, US dollars and even Cryptocurrencies. That way the risks are minimised and our returns are optimised.

@MillionaireTiger Market Trend

@TigerStars

Due to many uncertainties from geopolitical to inflation to pandemic recovery, and I don't have a crystal ball, hard to know if we will rebound orstay in correction. But I will buy the dip based on historical levels. e.g. $S&P 500(.SPX)$ at 4300, 4200, 3800 if it reach there as there are bounces that can be profitable whether we are in up or downtrend

Jerome Powell holds the fate of the markets in his hand when he testifies in Congress this week. The markets are currently whipsawed by the Ukrainian war and inflationary pressures. So there is lots of fear and uncertainties too. If Jerome Powell is less hawkish about the raising interest rates, the markets may simply rebound. But if he is adamant about increasing interest rates immediately then the markets may go into a tailspin.

Whatever it is, the markets always recover. Being a contrarian investor it is good to buy when there is Fear to maximise returns on the long haul.

@MillionaireTiger Market Trend Rebound or Stay in Correction

@TigerStars

I think the Markets direciton will be clearer after this week (FED chair speaks, NFP) and what happen geopolitically. Market usually rise after geopolitcal and first rate hike, and seasonality also points to likely rebound in March. I will keep some capital and buy the dip at right level using s$SPDR Portfolio S&P 500 ETF(SPLG)$

However as we see, the market surprising go bull instead.

Though, I still think it's a 🐻 market.

Correction will come, I guess.

So, whatever win now may become a lost later.

personally I nibble a bit here and there but still find my average is high [Sad]

Did not bother to catch falling knife.