🚀Key events in the coming week, share your trading plans!

Hi, Tigers!

Welcome to Daily Discussion! This is the place for you to share your trading ideas and win coins!

[Rewards]

We will reward you with 50 Tiger Coins when you share your knowledge about stocks and markets here, depending on quality and originality.

(NOTE: Comments posted under this article WILL NOT be counted)

2.You will be given 5 Tiger coins if you tag more than 3 friends in the comment area

Meanwhile, we will be listing the stocks mentioned by those selected Tigers for your reference every day (not investment advice though)

Is there anything you would like to share about your trades today?

[Winners Announcement: 21 Aug]

1.Here are the 6 Tigers whose post has the best quality & interaction last Friday: @ZEROHERO @nerdbull1669 @melson @JC888 @koolgal @0QH

Congratulations on being offered 50 Tiger Coins!

Brace For Stock Options Expiry (OPEX) Friday 😅

Investing in Energy Stocks (ExxonMobil, ConocoPhillips) When Oil Prices Soar

In A Falling US Market, One "Good" Stock To Buy?

2.Here are the stocks mentioned by the above Tigers: $Invesco QQQ Trust-ETF(QQQ)$ $ConocoPhillips(COP)$ $Exxon Mobil(XOM)$ $NVIDIA Corp(NVDA)$ $Amazon.com(AMZN)$ $Tesla Motors(TSLA)$ $Apple(AAPL)$ $Microsoft(MSFT)$

(Not investment advice)

And let's congratulate these Tigers for winning 5-40 Coins:

Below are Today's Key Takeaways.

Top News Move the Market

Weekly Hot Stocks

⭐For The Daily Most Active Stocks in S&P 500 & The Top 10 Popular Stcocks on WallStreetBets please turn to @TigerObserver

Global Markets Weekly Update

Stocks were broadly lower as sentiment appeared to take a blow from a sharp increase in longer-term bond yields and fears of a sharp slowdown in China (see below). The S&P 500 Index ended the week down 5.15% from its July 26 intraday peak. Growth shares should theoretically suffer the most as rising rates place a greater discount on future earnings, but the Russell 1000 Growth Index held up modestly better than its value counterpart. Small-cap stocks performed the worst. T. Rowe Price traders noted that program trading, technical factors, and thin summer trading volumes may have accentuated the market’s swings.

Whether the economy was slowing and by how much may arguably have become less clear since the Fed’s meeting, however. The Atlanta Fed’s GDPNow forecast for growth in the current quarter, which is continually revised based on incoming data, jumped to 5.8% as of Wednesday, well above the official second-quarter growth rate of 2.4%. While most expect the actual growth rate in the third quarter to come in substantially lower, the Atlanta Fed’s “Blue Chip” survey of economists indicated that most are also steadily revising higher their growth forecasts. Nevertheless, rate hike expectations as measured by the CME FedWatch tool remained roughly stable over the week, with futures markets pricing in the likelihood of rates staying at their current level through the end of the year.

The positive economic surprises pushed the yield on the benchmark 10-year U.S. Treasury yield to its highest level since at least October 2022, although heavy issuance and, thus, supply worries may have also played a role. According to our traders, tax-exempt municipal bonds were initially resilient to the heightened volatility in Treasuries, but muni yields jumped on Thursday. Nevertheless, new deals were well subscribed, as attractive new issue concessions appeared to bolster demand.

Investment-grade corporate bonds underperformed Treasuries throughout the week, led by the auto sector. Roughly half of the week’s issuance was oversubscribed, however. Meanwhile, market volumes in the high yield bond and bank loan segments were somewhat below average, and our traders noted that much new issuance may be delayed until after the Labor Day holiday.

Futures & Commodities

New York gold futures prices closed higher on Friday. Previously, the futures had fallen for nine consecutive trading days. Gold for December delivery rose $1.30, or less than 0.1%, to settle at $1,916.50 an ounce on the Comex on Friday. The futures fell 1.54% this week.

U.S. WTI crude oil futures ended higher on Friday, but fell more than 2% for the week and ended a seven-week winning streak. West Texas Intermediate crude for September delivery rose 86 cents, or 1.1%, to settle at $81.25 a barrel on the New York Mercantile Exchange on Friday. The futures fell 2.33% this week, ending the previous seven consecutive weeks of gains.

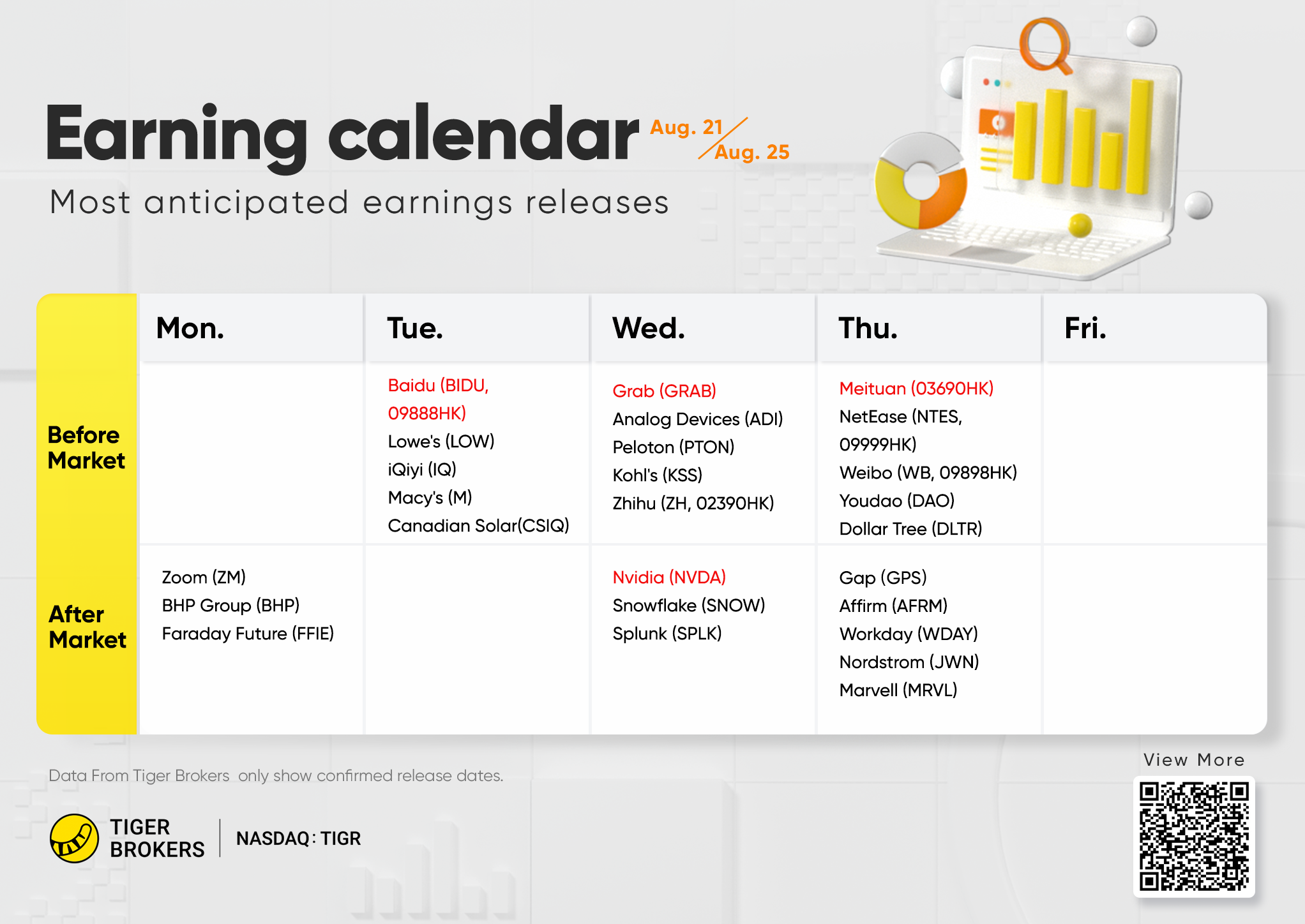

The week ahead : August 21-25

Economic calendar

Earnings calendar

Click to Post in the Topic >>

Or tag the topic when you make a post

Share your ideas on the trading opportunities or the market trends, and you will win coins!

Stay safe and good luck with your investing!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Thanks @Daily_Discussion for your wonderful Tiger Coins which are greatly appreciated ❤️

@LMSunshine @Mrzorro @Aqa @Fenger1188 @GoodLife99 @rL @Shyon @icycrystal @xXxZealandxXx @DiAngel @SirBahamut @HelenJanet @pekss @Korer @JC888 @melson

@b1uesky @Shyon @rL @Aqa

@CL Wong @MeowKitty @joonkee @Derrick_1234 come and join me

@Thonyaunn @MeowKitty @joonkee @Derrick_1234 come and join me

Thanks to all those who tagged me 🍀🍀🫰🫰

@CL Wong @MeowKitty @Thonyaunn @joonkee come and join me